With Market Analysis for Forecasting at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights. Market analysis is a vital component in predicting future trends and making informed business decisions, ultimately leading to success in a competitive market landscape.

In this comprehensive guide, we will explore the importance of market analysis, different types of analysis methods, the impact of market volatility, and emerging trends in the field, offering valuable insights for businesses looking to stay ahead of the curve.

Importance of Market Analysis

Market analysis plays a crucial role in forecasting future trends and helping businesses make informed decisions. By examining various market factors, businesses can better understand consumer preferences, industry trends, and competitive landscapes. This allows them to anticipate changes and plan accordingly, ultimately leading to improved performance and profitability.

Understanding Consumer Behavior

Market analysis provides valuable insights into consumer behavior, enabling businesses to tailor their products and services to meet customer needs. By analyzing purchasing patterns, demographics, and preferences, companies can develop targeted marketing strategies that resonate with their target audience. For example, a retail company may use market analysis to identify popular products and adjust their inventory accordingly, leading to increased sales and customer satisfaction.

Identifying Industry Trends

Market analysis helps businesses stay ahead of industry trends by monitoring market dynamics, emerging technologies, and competitor activities. By keeping a close eye on these factors, companies can anticipate shifts in the market and adjust their strategies proactively. For instance, a tech company may use market analysis to identify upcoming trends in the digital space and invest in research and development to launch innovative products ahead of competitors.

Competitive Analysis

Market analysis allows businesses to conduct competitive analysis and benchmark themselves against industry peers. By evaluating competitor strengths and weaknesses, companies can identify gaps in the market and develop unique selling propositions to differentiate themselves. For example, a hospitality company may analyze competitor pricing strategies and adjust their rates to stay competitive in the market, attracting more customers and increasing market share.

Types of Market Analysis

Market analysis plays a crucial role in forecasting and decision-making for businesses. It involves examining market trends, customer behavior, and competitive landscapes to gather insights for strategic planning. Let’s delve into the different types of market analysis:

Market Analysis vs. Market Research

Market analysis and market research are often used interchangeably, but they serve distinct purposes. Market research focuses on gathering data about a specific market, including customer preferences, buying habits, and market size. On the other hand, market analysis involves interpreting this data to identify opportunities, threats, and trends that can impact a business’s performance.

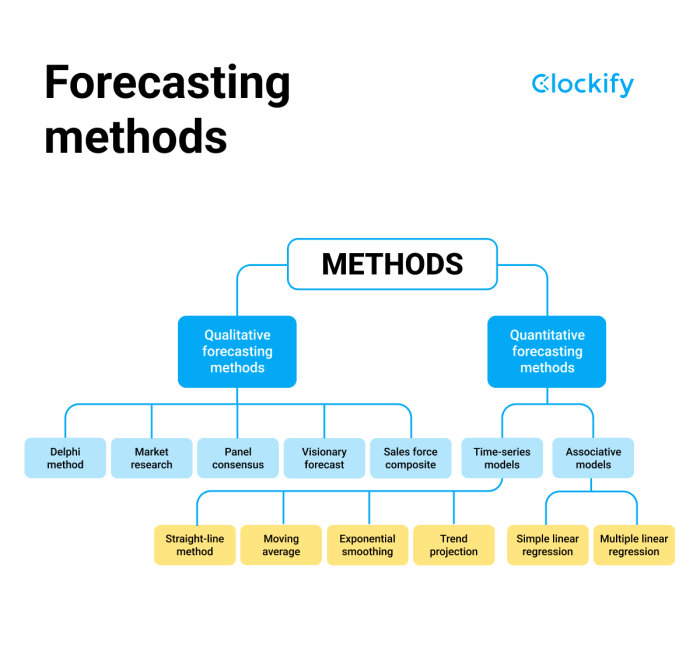

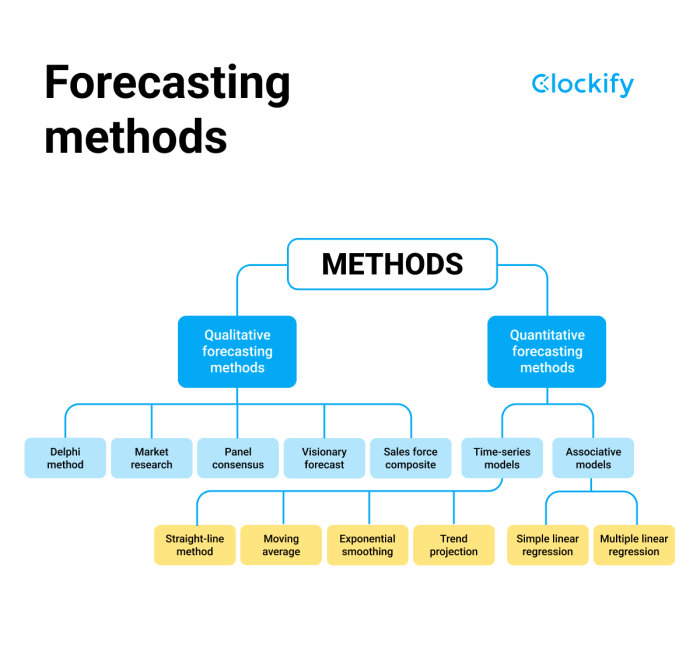

Qualitative vs. Quantitative Market Analysis

Qualitative market analysis involves gathering non-numerical data to understand consumer perceptions, preferences, and motivations. This type of analysis is subjective and aims to uncover insights that quantitative data may not capture. On the contrary, quantitative market analysis relies on numerical data to measure market trends, market share, and other statistical information. It provides concrete data for making informed decisions.

Tools for Conducting Market Analysis

Various tools are available to conduct market analysis efficiently. Some commonly used tools include:

- SWOT Analysis: A framework for identifying a company’s strengths, weaknesses, opportunities, and threats.

- PESTEL Analysis: Examines the political, economic, social, technological, environmental, and legal factors affecting a market.

- Market Segmentation: Dividing the market into segments based on demographics, psychographics, or behavior to target specific customer groups.

- Competitive Analysis: Evaluating competitors’ strategies, strengths, and weaknesses to identify opportunities for differentiation.

These tools help businesses gain a comprehensive understanding of the market landscape and make informed decisions to drive growth and profitability.

Market Volatility

Market volatility refers to the degree of variation in the price of a security or market index over a period of time. This fluctuation can impact the accuracy of forecasting, as unexpected changes in market conditions can lead to inaccurate predictions.

Impact on Forecasting Accuracy

Market volatility can make it challenging to predict future market trends accurately. Sudden price changes caused by volatility can disrupt forecasting models, leading to unreliable projections. This can result in financial losses for investors and businesses who rely on forecasting for decision-making.

- Increased uncertainty: Market volatility creates uncertainty about future market conditions, making it difficult to forecast trends accurately.

- Risk of overestimation or underestimation: Rapid price fluctuations can cause forecasting models to overestimate or underestimate market performance.

- Impact on investment decisions: Market volatility can influence investment decisions, leading to potential losses if forecasting is not adjusted to account for changing market conditions.

Strategies to Mitigate Risks

To mitigate the risks associated with market volatility, investors and businesses can implement the following strategies:

- Diversification: Spreading investments across different asset classes can help reduce the impact of market volatility on a portfolio.

- Risk management tools: Using options, futures, or other hedging instruments can protect against sudden market changes.

- Regular monitoring: Keeping track of market trends and adjusting forecasts based on new information can help mitigate the impact of volatility.

Industries Most Affected

Certain industries are more susceptible to the effects of market volatility due to their reliance on specific market conditions. Examples of industries that are highly affected by market volatility include:

1. Technology sector

Tech companies often experience significant stock price fluctuations in response to market volatility and changing investor sentiment.

2. Energy sector

Oil and gas companies are heavily influenced by fluctuations in commodity prices, making them vulnerable to market volatility.

3. Financial services

Banks and financial institutions can be impacted by market volatility, affecting their lending practices and investment decisions.

Trends in Market Analysis

Market analysis is constantly evolving, and staying updated on emerging trends is crucial for businesses to make informed decisions. Let’s explore some of the latest trends in market analysis techniques and how technology is revolutionizing the process.

Role of Technology in Market Analysis

Technology has played a significant role in revolutionizing market analysis processes. Advanced tools and software now allow for the collection, processing, and analysis of vast amounts of data in real-time. This has enabled businesses to gain valuable insights into market trends, consumer behavior, and competitive landscapes with greater accuracy and speed. The use of artificial intelligence and machine learning algorithms has further enhanced the predictive capabilities of market analysis, providing businesses with actionable insights to stay ahead of the competition.

Data Analytics in Market Analysis

Data analytics has transformed market analysis practices by enabling businesses to leverage data-driven insights to make strategic decisions. By utilizing sophisticated analytics tools, businesses can extract valuable information from complex datasets, identify patterns, and trends that were previously difficult to uncover. This allows for more accurate forecasting, risk assessment, and performance evaluation, ultimately leading to better decision-making and improved business outcomes.

The integration of data analytics into market analysis processes has become essential for businesses looking to stay competitive in today’s fast-paced and data-driven market environment.

In conclusion, Market Analysis for Forecasting serves as a compass for businesses navigating the ever-changing market dynamics. By leveraging the power of data and technology, companies can gain a competitive edge and make strategic decisions that drive growth and innovation. Stay informed, stay ahead, and watch your business thrive in the challenging world of market analysis.

FAQs

How does market analysis contribute to forecasting accuracy?

Market analysis provides businesses with valuable insights into market trends, consumer behavior, and competitive landscapes, enabling more accurate predictions of future market conditions.

What are some common tools used for conducting market analysis?

Popular tools for market analysis include SWOT analysis, PESTEL analysis, Porter’s Five Forces, and various data analytics software for gathering and interpreting market data.

How can businesses mitigate risks associated with market volatility?

Businesses can mitigate risks by diversifying their product offerings, maintaining a strong financial position, adapting quickly to changing market conditions, and implementing effective risk management strategies.