Market Volatility and Economic Cycles sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the intricate dance between market volatility and economic cycles sheds light on the complexities of financial landscapes, providing a compelling narrative that captivates both seasoned investors and curious minds alike.

Market Volatility

Market volatility refers to the fluctuation in the price of financial instruments such as stocks, bonds, and commodities over a certain period of time. It is a measure of the rate and magnitude of price changes in the market.

Factors Contributing to Market Volatility

- Economic Indicators: Reports on unemployment, GDP, inflation, and interest rates can influence market volatility.

- Geopolitical Events: Political instability, trade wars, and global conflicts can create uncertainty in the market.

- Corporate Earnings: Quarterly earnings reports and guidance from companies can impact stock prices.

- Investor Sentiment: Market sentiment and emotions like fear and greed can drive volatility.

Effects of Market Volatility

- Risk and Uncertainty: High volatility can increase risk and uncertainty for investors.

- Price Swings: Sharp price movements can lead to significant gains or losses in a short period.

- Market Liquidity: Volatility can impact liquidity and the ability to buy or sell assets at desired prices.

- Economic Impact: Market volatility can affect consumer confidence, business investment, and overall economic growth.

Economic Cycles

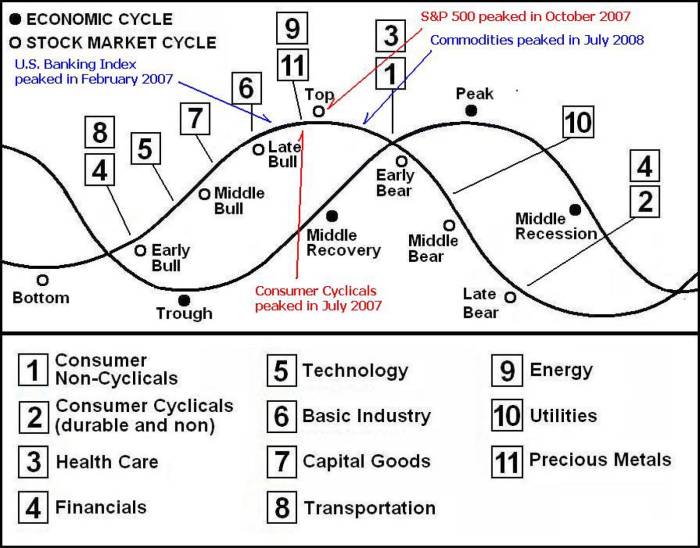

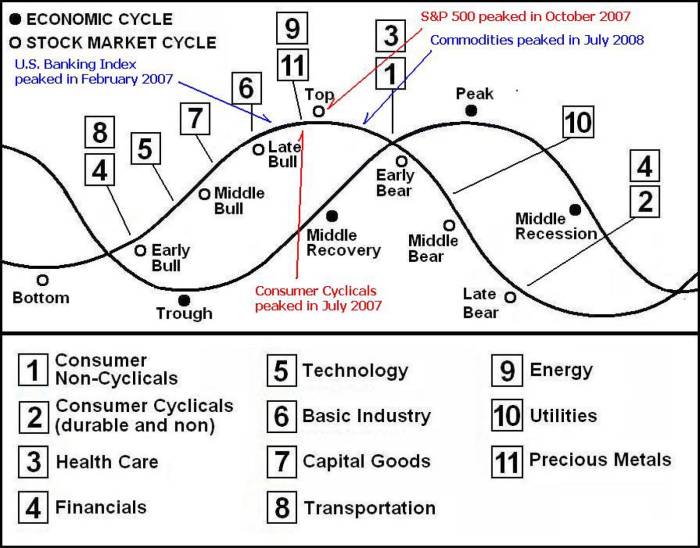

Economic cycles refer to the recurring patterns of expansion and contraction in an economy. These cycles are characterized by periods of growth, peak, contraction, and trough, with each phase having distinct characteristics and impacts on businesses and consumers.

Phases of Economic Cycles

- The Expansion Phase: This phase is marked by economic growth, increasing employment rates, rising consumer spending, and overall prosperity. Businesses experience high demand for goods and services during this phase.

- The Peak Phase: This phase represents the highest point of economic activity, with full employment, high levels of production, and maximum consumer spending. However, it also signals the beginning of a downturn.

- The Contraction Phase: Also known as a recession, this phase sees a decline in economic activity, rising unemployment rates, reduced consumer spending, and a slowdown in production. Businesses may struggle during this phase.

- The Trough Phase: This phase is the lowest point of the economic cycle, characterized by high unemployment, low consumer confidence, and reduced business activity. However, it also sets the stage for the next expansion phase.

Indicators of Economic Cycle Shifts

- Leading Indicators: These indicators, such as stock market performance, building permits, and consumer confidence, provide early signals of potential shifts in the economic cycle.

- Lagging Indicators: Indicators like unemployment rates, inflation, and corporate profits tend to confirm trends that have already begun, reflecting the current state of the economy.

- Coincident Indicators: These indicators, including industrial production and retail sales, move in conjunction with the overall economy, providing a real-time snapshot of economic conditions.

Adapting Business Strategies to Economic Cycles

- Diversification: Businesses can diversify their product offerings or target markets to mitigate the impact of economic downturns and leverage opportunities during periods of growth.

- Cost Management: Implementing cost-cutting measures, optimizing operational efficiency, and managing cash flow can help businesses navigate through challenging economic phases.

- Market Research: Conducting market research and staying attuned to consumer preferences and trends can enable businesses to tailor their strategies to meet changing demands across different economic cycles.

Market Analysis

Market analysis plays a crucial role in helping investors understand trends and make informed decisions in the financial markets. By analyzing various factors affecting market movements, investors can gain valuable insights that can guide their investment strategies.

Importance of Market Analysis

Market analysis is essential for investors to identify trends, patterns, and potential opportunities in the financial markets. It helps investors make informed decisions based on data and analysis rather than speculation or emotions. By understanding market dynamics, investors can better navigate the volatility and uncertainty often present in the markets.

- Technical Analysis: This method involves analyzing historical price data, volume, and other market indicators to forecast future price movements. Technical analysts use charts and graphs to identify patterns and trends that can help predict market direction.

- Fundamental Analysis: Fundamental analysis focuses on evaluating the financial health and performance of companies, industries, and economies. Analysts assess factors such as earnings, revenue, market trends, and economic indicators to determine the intrinsic value of an asset.

Market analysis provides investors with valuable insights that can help them make informed decisions and manage risks effectively.

How Market Analysis Helps Investors

Market analysis enables investors to identify potential investment opportunities, assess risk levels, and make well-informed decisions based on data and analysis. By utilizing different analysis methods, investors can develop a comprehensive understanding of the market environment and adjust their strategies accordingly.

- Identifying Trends: Market analysis helps investors identify trends and patterns that can guide their investment decisions. By recognizing market trends early, investors can capitalize on opportunities and avoid potential risks.

- Risk Management: Through market analysis, investors can assess the risk associated with different investments and develop risk management strategies to protect their portfolios.

- Decision Making: By analyzing market data and trends, investors can make informed decisions about buying, selling, or holding assets. Market analysis provides a solid foundation for decision-making in the financial markets.

Market Research

Market research is a crucial aspect of understanding consumer behavior and preferences, which can directly impact business strategies and decision-making.

Differentiate between market analysis and market research

Market analysis involves examining data and trends in the market to assess performance and make predictions, while market research focuses on gathering specific information about consumers, their needs, and their preferences.

Explain the role of market research in identifying consumer behavior and preferences

Market research helps businesses understand who their target audience is, what they want, and how they make purchasing decisions. By analyzing this data, companies can tailor their products, services, and marketing strategies to meet the needs and preferences of consumers.

Provide examples of how market research findings can influence business strategies

- Market research may reveal that a certain demographic prefers eco-friendly products, prompting a company to develop a new line of sustainable goods.

- By conducting surveys and focus groups, businesses can gather feedback on existing products and make improvements based on consumer suggestions.

- Through market research, companies can identify emerging trends and adjust their strategies to stay ahead of the competition.

Impact of Market Volatility on Market Research

Market volatility can significantly impact the reliability of market research data, as sudden fluctuations in the market can skew results and make it challenging to predict future trends accurately. In times of high market volatility, businesses need to adapt their market research strategies to ensure they are still gathering valuable insights to make informed decisions.

Strategies for Conducting Market Research in Times of High Market Volatility

- Stay agile and flexible in research methodologies to quickly adjust to changing market conditions.

- Focus on real-time data collection and analysis to capture the most up-to-date information.

- Diversify data resources and incorporate multiple data points to reduce the impact of outliers.

- Engage with customers and stakeholders more frequently to understand changing needs and preferences.

- Utilize advanced analytics and predictive modeling to identify patterns and trends amid market volatility.

How Businesses Can Use Market Research to Navigate Uncertain Market Conditions

- Identify emerging opportunities and threats by conducting thorough market research to stay ahead of competitors.

- Segment target markets based on changing consumer behaviors and preferences to tailor products and services effectively.

- Monitor competitor activity and market trends closely to adjust strategies in response to market volatility.

- Utilize market research insights to optimize marketing campaigns and messaging to resonate with consumers during uncertain times.

- Seek feedback from customers through surveys and feedback mechanisms to understand how market volatility is impacting their purchasing decisions.

As we conclude this exploration of Market Volatility and Economic Cycles, it becomes evident that these intertwined phenomena are not just trends but crucial components of the financial ecosystem that shape investment decisions and business strategies alike.

Questions and Answers

How does market volatility impact long-term investment decisions?

Market volatility can lead to short-term fluctuations in stock prices, but prudent investors often view it as an opportunity to buy low and hold for the long term.

What are some key indicators of an upcoming economic downturn?

Indicators such as an inverted yield curve, rising unemployment rates, and declining consumer spending are often signals of an impending economic downturn.

How can businesses adjust their strategies during economic recessions?

During economic recessions, businesses can focus on cost-cutting measures, diversifying revenue streams, and strengthening customer relationships to weather the storm.